RustyShackleford

Supporter

- 63,018

- 189,186

- Joined

- Jul 20, 2009

tax breaks is da money u make u keep...if government makes it easier to keep your own money, you'll put it to work.

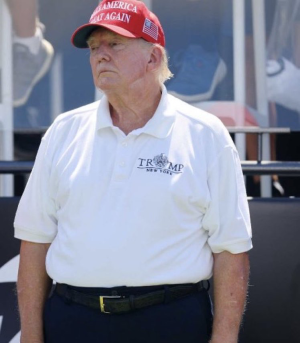

Trump said he was gonna lower taxes and provide incentives for companies to stay.

so far so good

Trump said he will punish companies that tried to leave.

And you're deflecting because you don't understand the issue. There is nothing requiring you to "put you money to work'

Low interest rates are also suppose to incentivize private sector investment, but that has not been happening the way you would expect.