cl-1b

Banned

- 1,166

- 126

- Joined

- Jul 6, 2015

If you consider all the properties in the network Ritz included it really works out. Every anniversary after 1 year, you get a free nights stay as well. I travel a lot and i feel like there might be better cards out there but i really like how they treat you with this one... Esp if you are interested in racking up Marriott rewards as well.Gotta look into this card. I stay with Marriott the most, people think this is the best one to get?Used my chase Marriott card for a quick stay in Miami this wknd at a Marriott property.. Got 6am early check in and 3 pm late check out the next day no charge.

Last edited:

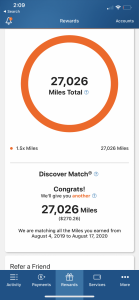

. I already have 30k miles with Delta, so it'll make for a nice round trip somewhere.

. I already have 30k miles with Delta, so it'll make for a nice round trip somewhere.

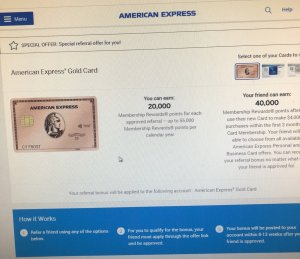

. I will do some research on it later tonight.

. I will do some research on it later tonight.