- 4,270

- 4,306

- Joined

- Jul 20, 2012

S southernhospita

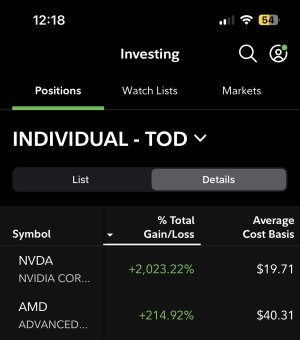

You’re Right My Dude….Melvin Is THRIVING

I’ll Let It Rest And We Can Revist Come End Of Q2 If You’d Like To

still not relevant to you saying they don’t have any capital when they have 17 billion in holding

We don’t need to revisit it

You said they dont have capital when they do obviously you worried about a website and a building

But that 17 billion holds more weight than what you are talking about

I think you don’t know what capital mean and

That’s ok

Nice try though

Last edited: