- 4,263

- 4,286

- Joined

- Jul 20, 2012

Melvin Has No More Capital To Short With At This Point. They Got Squashed Back During The GME Initial Squeeze….. Give Their Website A Visit And Tell Me If That Looks Like A $20B Site To You Now…

I don’t think that’s the case

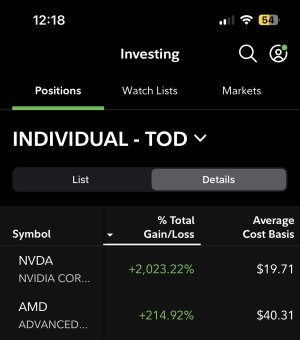

You can literally look up what they are holding