- 74,542

- 23,972

- Joined

- Apr 4, 2008

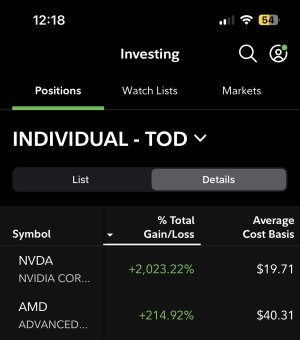

grab the William O’Neil book. You gotta figure out what your approach is what indicators you use. Try to play around with things and see what makes sense to you and see if you can create an elevator pitch for who you are as an investor or trader. I trade stocks that enter price discovery using auction market theory for my entries and exits. Others use moving averages, fibs, Elliot wave, anchored vwap, you’ll find your edge and niche in time.What are some resources or things you use to figure out what’s a good price for you? Super new to buying stocks and that’s my biggest problem right now. I got “lucky”’because I purchased around March 20th when prices were a steal.

just started reading this book.

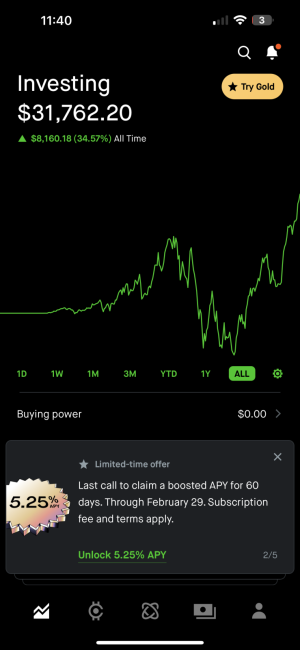

Would be very healthy for the long term prospects if we see a couple of more down days followed by consolidation.If i get some of my school reimbursement money Friday I might add 2 more shares of Tesla

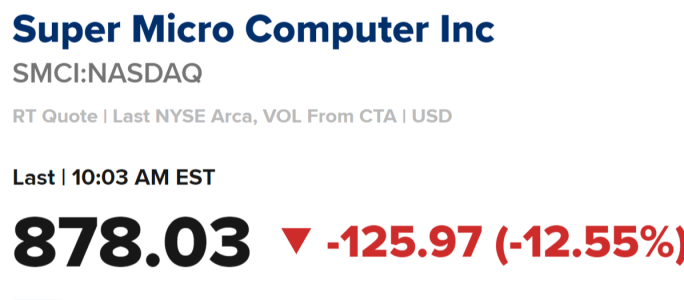

i hope this isnt a major pull back that will continue for a while.