- 1,260

- 365

- Joined

- Aug 15, 2004

Keeney stresses the significance of Tesla setting up a human ride hailing network to help accelerate the progress towards a full autonomous robotaxi network. She says the $5 Billion capital raise will only help Tesla grow quicker via building more factories. This will lead to more and more Tesla's being on the road, which will help improve Tesla's AI system in autonomous driving through all the road data it collects. This will result in Tesla's accelerated path to finally implementing its robotaxi network!

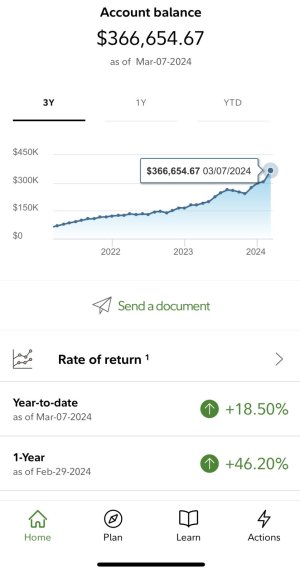

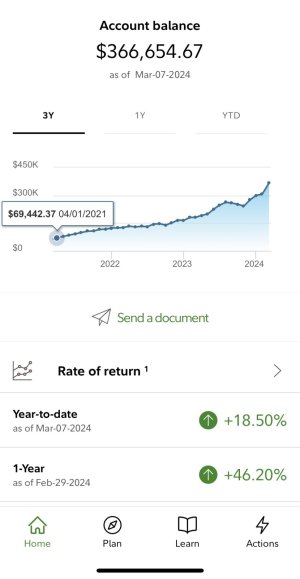

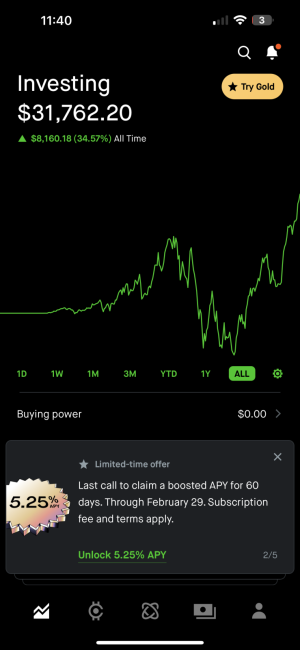

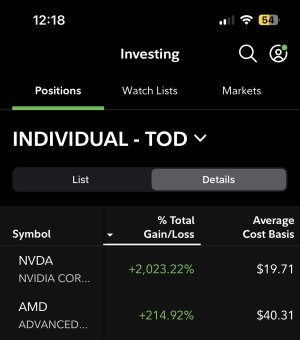

Havent changed the shares I hold, now worth more than my AAPL position I've held forever

Havent changed the shares I hold, now worth more than my AAPL position I've held forever