- 6,374

- 3,694

- Joined

- Mar 1, 2011

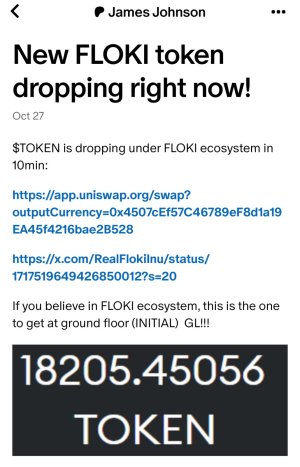

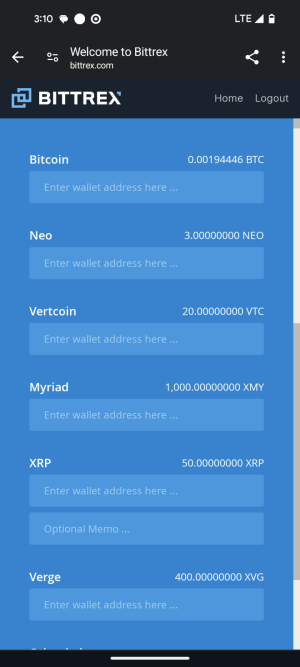

Please read this. And if you still want to pump XRP, by all means.

And this:

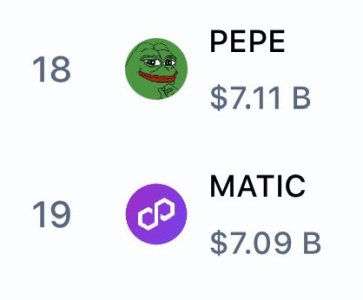

Most of the general public fails to realize the value props BTC offers that no sh-coin does: decentralization and provable scarcity. But go ahead and own something the owners have majority stake in and no transparency around.

If your only goal is to make money, then sure, XRP will pump when BTC pumps. But I'd recommend people look at the % back to their ATH today and compare it to BTC's. Same cycle will happen to these useless coins in the next bear market.

are you imposing that only btc will thrive in the future?

you do know that bitcoin is centralized, right?