- 29,657

- 39,372

- Joined

- May 25, 2004

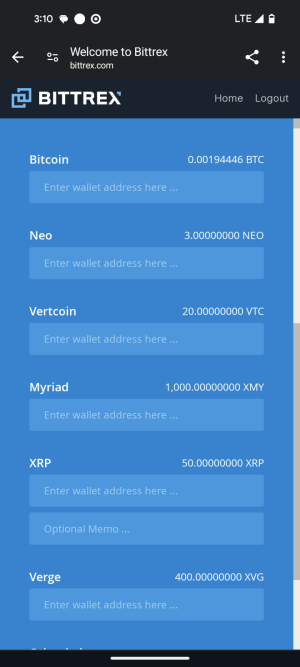

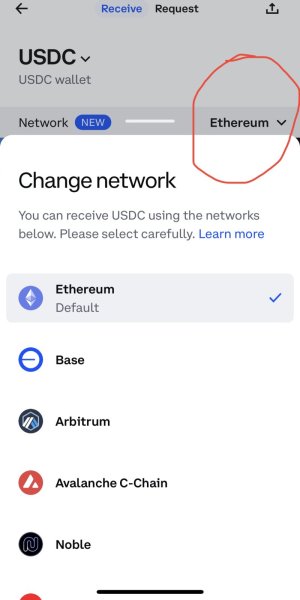

Serious question, what do you guys do when you gotta have your phone worked on by Apple or something?

just log out of your app? Like you got google wallet, Coinbase and all this stuff on your phone. My bank is insured but say you had hella money in Coinbase and they transferred it to themselves you’re assed out...

just log out of your app? Like you got google wallet, Coinbase and all this stuff on your phone. My bank is insured but say you had hella money in Coinbase and they transferred it to themselves you’re assed out...

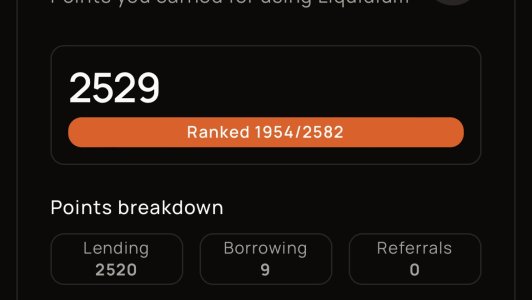

I gotta enable that I guess.

I gotta enable that I guess.