- 10,459

- 8,935

- Joined

- Mar 4, 2011

Stable Coin Regulation, With A Focus On The STABLE Act

www.forbes.com

www.forbes.com

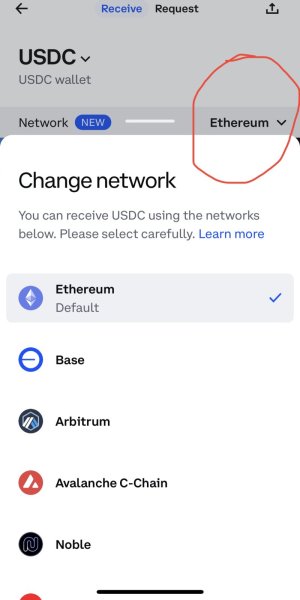

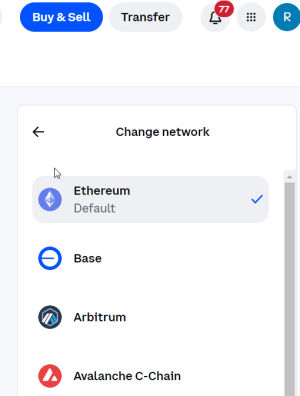

What are stable coins? Of course the generic smart-aleck answer to explain these compound words is that they are neither stable nor coins. For example: smart contracts are neither smart nor contracts. A stable coin similar to USDC is meant to keep its value pegged to the US Dollar at 1:1. The only residual volatility in USDC is the volatility of USD. The user enters into a contract with Circle Financial Corp when they buy USDC which appears to guarantee that one USD is always convertible to one USDC and one USDC is convertible to one USD. The phrase “appears to” is in bold for reasons given later in the article. This applies to other USD based stable coins like USDT (or Tether). USDC is used as an example in this article. Once the fiat currency in a deposit account or a credit-line is converted to a stable coin, it is untethered from the fiat and can freely move around in the crypto-verse. In the case of USDC, it is supported on Ethereum, Solana and Algorand public chains.

The amount of USDC issued has increased from around $1B at the beginning of the year to around $3B at the end of November. USDT has increased to around $20B. Why is so much money flowing into stable coins? The cryptocurrency (CC) market is on a tear, the US Dollar is not directly available on CC markets, but the USD pegged stable coins are. In order to use USD to trade CC, there are two choices. Choice number one is to use an exchange to buy USD for a particular CC and hold on to it, either in a self-hosted wallet or in the exchange’s wallet, to sell the crypto-currency for USD, an off-ramp has to be used, usually an exchange. Choice number two is much better, convert the USD to a stable coin like USDC which can be held in a USDC wallet, use the USDC to buy CC. USDC is a native asset in the digital marketplace, the trades can happen independently and cheaply back and forth between USDC and the CC. Further, since CC trading happens 24/7/365. Holding volatile CCs make for sleepless nights and weekends. So during these times, when volatility is expected, the CC can be moved into a stable coin, especially if the price of the CC is expected to fall rapidly. Of course any upside in the CC is also lost. There is an excellent analysis of the asymmetric demand for stable coins in an article by Frances Coppola. She uses USDT as an example and ties it to the volatility of bitcoin.

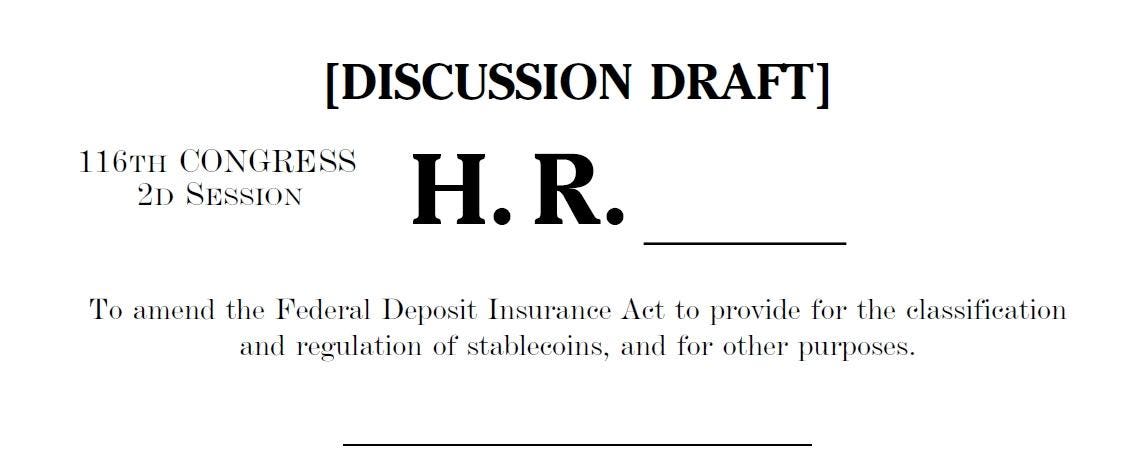

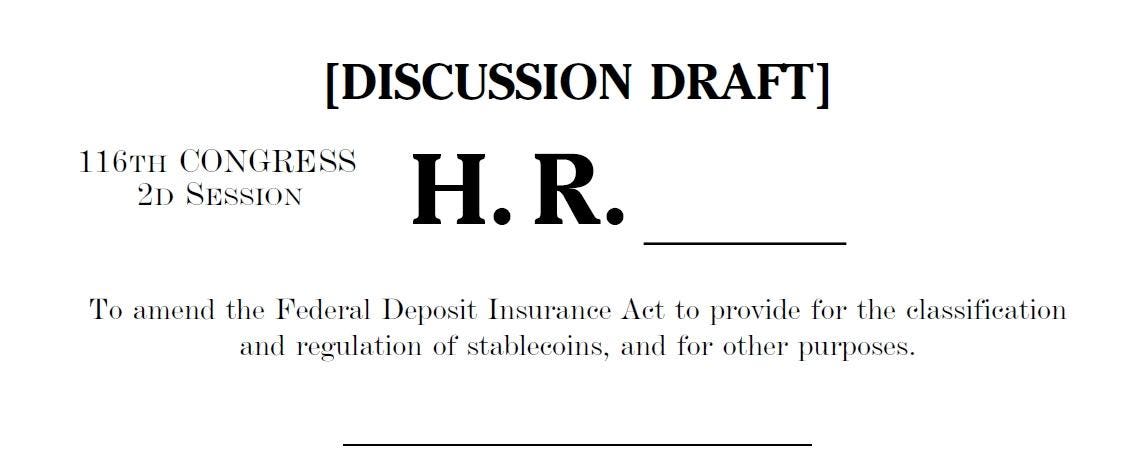

Two significant risks are ever present in the stable coin ecosystem of today. The first one is KYC/AML/CFT. The user has to be identified and should not belong to the proscribed set of users, this data is also used for reporting taxable events to the IRS. The second risk is the surety of the peg: one USD for one USDC. In order to assure the peg, the USD received from the user has to be stored in commercial bank accounts, a significant portion in low-duration instruments. The lowest duration instrument is a checking account. A checking account yields zero interest. This liquidity is needed to satisfy a run on the stable coin. In other words, a surge in demand to convert USDC to USD needs to be covered. Guarantees tied to cash held in commercial banks on behalf of the users has attracted the attention of regulators and legislators. The STABLE Act proposed by some legislators should be seen in this light. The rest of the article is about the appropriateness of the proposals given below.

Require any prospective issuer of a stable coin to obtain a banking charter;

Require that any company offering stable coin services must follow the appropriate banking regulations under the existing regulatory jurisdictions;

Require that any company or bank issuing a stable coin to notify and obtain approval from the Fed, the FDIC, and the appropriate banking agency 6 months prior to its issuance and maintain an ongoing analysis of potential systemic impacts and risks;

And require that any stable coin issuers obtain FDIC insurance or otherwise maintain reserves at the Federal Reserve to ensure that all stable coins can be readily converted into United States dollars, on demand.

Basically, it says that all stable coin issuers should get a banking charter, almost all the other proposals follow in its footsteps. From the language, the shadow of the impending release of Diem, previously known as Libra, is on top of the legislators minds. A borderless entity with 2.7 billion built-in customers is a threat to even large sovereign governments. Ostensibly, STABLE Act is to protect Low and Middle Income (LMI) customers. There is an attempt to tar all of the stable coin issuers with the shadow banking brush. More on that subject la

ter.

ter.

Stable Coin Regulation, With A Focus On The STABLE Act

An analysis of stablecoin regulation proposed by the STABLE Act. Based on readings of the act itself, the contracts and audits from USDC. 2021 augurs more regulation overall and a focus on the parts of the crypto-currency market that can be regulated. These include exchanges and stablecoins.

www.forbes.com

www.forbes.com

What are stable coins? Of course the generic smart-aleck answer to explain these compound words is that they are neither stable nor coins. For example: smart contracts are neither smart nor contracts. A stable coin similar to USDC is meant to keep its value pegged to the US Dollar at 1:1. The only residual volatility in USDC is the volatility of USD. The user enters into a contract with Circle Financial Corp when they buy USDC which appears to guarantee that one USD is always convertible to one USDC and one USDC is convertible to one USD. The phrase “appears to” is in bold for reasons given later in the article. This applies to other USD based stable coins like USDT (or Tether). USDC is used as an example in this article. Once the fiat currency in a deposit account or a credit-line is converted to a stable coin, it is untethered from the fiat and can freely move around in the crypto-verse. In the case of USDC, it is supported on Ethereum, Solana and Algorand public chains.

The amount of USDC issued has increased from around $1B at the beginning of the year to around $3B at the end of November. USDT has increased to around $20B. Why is so much money flowing into stable coins? The cryptocurrency (CC) market is on a tear, the US Dollar is not directly available on CC markets, but the USD pegged stable coins are. In order to use USD to trade CC, there are two choices. Choice number one is to use an exchange to buy USD for a particular CC and hold on to it, either in a self-hosted wallet or in the exchange’s wallet, to sell the crypto-currency for USD, an off-ramp has to be used, usually an exchange. Choice number two is much better, convert the USD to a stable coin like USDC which can be held in a USDC wallet, use the USDC to buy CC. USDC is a native asset in the digital marketplace, the trades can happen independently and cheaply back and forth between USDC and the CC. Further, since CC trading happens 24/7/365. Holding volatile CCs make for sleepless nights and weekends. So during these times, when volatility is expected, the CC can be moved into a stable coin, especially if the price of the CC is expected to fall rapidly. Of course any upside in the CC is also lost. There is an excellent analysis of the asymmetric demand for stable coins in an article by Frances Coppola. She uses USDT as an example and ties it to the volatility of bitcoin.

Two significant risks are ever present in the stable coin ecosystem of today. The first one is KYC/AML/CFT. The user has to be identified and should not belong to the proscribed set of users, this data is also used for reporting taxable events to the IRS. The second risk is the surety of the peg: one USD for one USDC. In order to assure the peg, the USD received from the user has to be stored in commercial bank accounts, a significant portion in low-duration instruments. The lowest duration instrument is a checking account. A checking account yields zero interest. This liquidity is needed to satisfy a run on the stable coin. In other words, a surge in demand to convert USDC to USD needs to be covered. Guarantees tied to cash held in commercial banks on behalf of the users has attracted the attention of regulators and legislators. The STABLE Act proposed by some legislators should be seen in this light. The rest of the article is about the appropriateness of the proposals given below.

Require any prospective issuer of a stable coin to obtain a banking charter;

Require that any company offering stable coin services must follow the appropriate banking regulations under the existing regulatory jurisdictions;

Require that any company or bank issuing a stable coin to notify and obtain approval from the Fed, the FDIC, and the appropriate banking agency 6 months prior to its issuance and maintain an ongoing analysis of potential systemic impacts and risks;

And require that any stable coin issuers obtain FDIC insurance or otherwise maintain reserves at the Federal Reserve to ensure that all stable coins can be readily converted into United States dollars, on demand.

Basically, it says that all stable coin issuers should get a banking charter, almost all the other proposals follow in its footsteps. From the language, the shadow of the impending release of Diem, previously known as Libra, is on top of the legislators minds. A borderless entity with 2.7 billion built-in customers is a threat to even large sovereign governments. Ostensibly, STABLE Act is to protect Low and Middle Income (LMI) customers. There is an attempt to tar all of the stable coin issuers with the shadow banking brush. More on that subject la