- 74,416

- 23,893

- Joined

- Apr 4, 2008

not touching oil just yet. gonna give it lil more time to see what it does.

grabbed a VIX call spread small just to have volatility exposure. April 23-28 for .80. 2 lot. basically a hedge.

took the EBAY calls off for a 4 cent loss. should've popped at the open, didn't so I got out.

I'm gonna look to do something with DIS in the near future. Not sure what yet but I wanna get long.

Might take a look at something YHOO as well, like a call fly if I get a good price. Not sure. implied move for Feb and March is like 7 and 8 bucks. Could head lower of course, but looks like there's some action on the horizon.

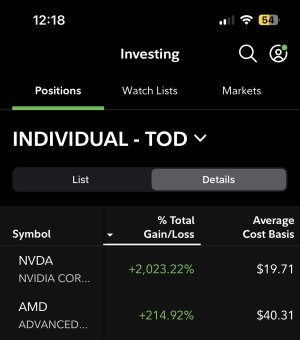

huge put action in AMD today. bunch of july 2.5 puts and some small orders sprinkled. 1.5 jan 2016 puts. not taking it but someone could be playing for bankruptcy.

grabbed a VIX call spread small just to have volatility exposure. April 23-28 for .80. 2 lot. basically a hedge.

took the EBAY calls off for a 4 cent loss. should've popped at the open, didn't so I got out.

I'm gonna look to do something with DIS in the near future. Not sure what yet but I wanna get long.

Might take a look at something YHOO as well, like a call fly if I get a good price. Not sure. implied move for Feb and March is like 7 and 8 bucks. Could head lower of course, but looks like there's some action on the horizon.

huge put action in AMD today. bunch of july 2.5 puts and some small orders sprinkled. 1.5 jan 2016 puts. not taking it but someone could be playing for bankruptcy.

Last edited: