- 21,216

- 11,807

- Joined

- Oct 10, 2005

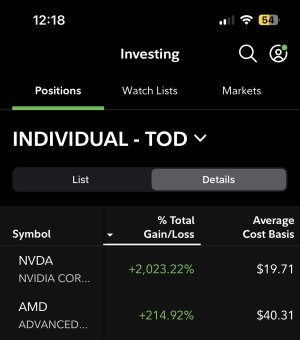

I hope for his sake he cashes in sooner rather than later and knows this isn't normal. I knowjohnnyredstorm and I have lurked WSB for years, and it has NEVER been this easy for those degens to win. And it's not because of extra DD or someone unlocking some secret. It's this market, which is a once in a lifetime experience. And this will RUIN people before it's over. GME might be a legit squeeze and some damn fine work done by a handful of very influential people. BB? BBBY? PLTR? Nah, those arent it. Its luck and gambling. Survivors bias. No one should look at this past 9 months of market action and think that it's this easy, or it'll continue. The rug pull, and there is always a rug pull, will be more brutal than I think I've ever seen in my life.

Thank you coming to my TED Talk.

I’ve been telling him to be careful and take profits, which he has been doing, but we’ll see when the rug finally gets pulled.

I've made money on it every time, but I'm ok with being out of it here, I want the cash position it gives me. My whole process has been refocused now to trying to own companies where their TAM could be the entire planet. That's where my highest conviction will be and then on a smaller scale, I look for the bet growth opportunities like DKNG, FTCH, JMIA, etc. I like those companies a lot long term, but when I need to add cash, I feel safest pulling from them to keep perspective.

I've made money on it every time, but I'm ok with being out of it here, I want the cash position it gives me. My whole process has been refocused now to trying to own companies where their TAM could be the entire planet. That's where my highest conviction will be and then on a smaller scale, I look for the bet growth opportunities like DKNG, FTCH, JMIA, etc. I like those companies a lot long term, but when I need to add cash, I feel safest pulling from them to keep perspective.