Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OFFICIAL STOCK MARKET AND ECONOMY THREAD VOL. A NEW CHAPTER

- Thread in 'General' Thread starter Started by johnnyredstorm,

- Start date

- 28,370

- 16,799

- Joined

- Mar 22, 2003

My best guess: Precision beauty and precision nutrition: tailoring products for those w/ preexisting conditions

Nailed it - don’t forget the data play and the scale that Nestle brings (pet care, operations, etc.)

- 1,097

- 729

- Joined

- Jan 12, 2017

would you say insurance companies have the most to gain (or lose) w/ a genomics M&A?Nailed it - don’t forget the data play and the scale that Nestle brings (pet care, operations, etc.)

- 583

- 783

- Joined

- Sep 4, 2020

This is my plan for my shoe and Mitchell & Ness collections. I hope my kid is into that **** because he will have options for days.I’ll be handing mine down to my kids someday - let them rock THE HEAT

- 12,589

- 27,234

- Joined

- Aug 9, 2014

I thought you joined NT for this thread onlyThis is my plan for my shoe and Mitchell & Ness collections. I hope my kid is into that **** because he will have options for days.

- 583

- 783

- Joined

- Sep 4, 2020

I did LOL. I hope I am not sent to the gulag, but ISS was my forum during my heavy shoe / jersey days.I thought you joined NT for this thread only

Sorry in advance.

- 7,084

- 45

- Joined

- Jan 29, 2007

Been holding out this week thinking we were going to get a big correction. SPY and futures currently near all time highs which means I couldn’t have been more wrong which resulted in a lot of missed opportunities.

Lesson learned, just keep DCAing as you see fit.

Lesson learned, just keep DCAing as you see fit.

- 12,589

- 27,234

- Joined

- Aug 9, 2014

No that’s coolI did LOL. I hope I am not sent to the gulag, but ISS was my forum during my heavy shoe / jersey days.

Sorry in advance.

just thought it was funny you joined for the stock market thread but also into sneakers and M&N lol

just thought it was funny you joined for the stock market thread but also into sneakers and M&N lol- 28,370

- 16,799

- Joined

- Mar 22, 2003

NO ISS TALK

THEY HAVE BEEN A RIVAL OF MINE LONG BEFORE THE SEC AND ROBINHOOD

THEY HAVE BEEN A RIVAL OF MINE LONG BEFORE THE SEC AND ROBINHOOD

- 583

- 783

- Joined

- Sep 4, 2020

Lol naw I was heavy in the game my entire life. I bought a pair of 11 Adapts to wear to graduation this year lol. Just found out it's gonna be virtual but will still rock them on the Zoom.No that’s cooljust thought it was funny you joined for the stock market thread but also into sneakers and M&N lol

I like many others but a point where shoes didn't make much sense vs. investing and general life stuff.

Now I only buy a pair if I make 5x the amount in the market. So one day I locked in $2,500 profits and bought the Adapts. My little rule to feed the beast but keep it mature lol.

- 74,437

- 23,917

- Joined

- Apr 4, 2008

price anchoring prevents wealth. If you like a company and the fundamentals make sense, a higher price (that was increased organically) is just confirmation of your thesisI smh every time SHOP is mentioned. I was eying it before covid and was “waiting for a better price”... lesson learned.

I need to start a position in GDRX asap.

you’re never going to nail tops and bottoms, all you can do is spot patterns. Stocks in an uptrend that make a higher low and are grinding off of it offer the best set ups. Look at the APPS ETSY FVRR charts from two days ago, that’s all you can do the next time is try to spot that recovery after a dip and manage around it. Having said that, I messed up not taking those (APPS was off limits because of earnings) for swings because I looked at them strictly as day trades or investments instead of cash flow trades to park my money w good r/r. We’re all gonna make mistakes regardless of experience, all you can do is reflect, learn, realize what’s happening the next time.Been holding out this week thinking we were going to get a big correction. SPY and futures currently near all time highs which means I couldn’t have been more wrong which resulted in a lot of missed opportunities.

Lesson learned, just keep DCAing as you see fit.

- 29,556

- 20,798

- Joined

- Dec 23, 2009

Figuring out how to add some MTCH into my portfolio. Tinder ads are all over TV. Reopening is going to spike online dating and hookups. People cooped up and depressed will be all over the Match Group products.

- 74,437

- 23,917

- Joined

- Apr 4, 2008

Took 5 shares of ESTC for a swing at like 163.60. Stop at 162. Targeting 176, 180+. Same pattern as ETSY and FVRR except this one is through its supply zone so it should be a little more free to run here(pull up the Etsy chart and lay it next to this one, that’s the hope and plan). Would’ve taken more but I don’t have much cash free. This is just a better than cash position trade that I’m going to try and replicate, compounding and growing within my account over time. 99% long term invested, 1% fun money with a tight stop. Only thing that can screw me is gap down risk because of a black swan event. Will not hold this through earnings at all.

this is a great company with good solid growth. I’ll only swing trade companies like this that I believe in over time. No reason to own garbage.

dis really strong. Through 181 you have 183 and then a nice clear breakout and what should become a 200 magnet. Very glad I added at 162 during the liquidation. Wish I had the cash to add more lol

this is a great company with good solid growth. I’ll only swing trade companies like this that I believe in over time. No reason to own garbage.

dis really strong. Through 181 you have 183 and then a nice clear breakout and what should become a 200 magnet. Very glad I added at 162 during the liquidation. Wish I had the cash to add more lol

Last edited:

- 9,832

- 3,228

- Joined

- Jan 22, 2015

- 4,281

- 1,172

- Joined

- Feb 5, 2011

Most anticipated earnings report ever for me with Pinterest rn

- 1,198

- 1,024

- Joined

- Nov 17, 2013

price anchoring prevents wealth. If you like a company and the fundamentals make sense, a higher price (that was increased organically) is just confirmation of your thesis

you’re never going to nail tops and bottoms, all you can do is spot patterns. Stocks in an uptrend that make a higher low and are grinding off of it offer the best set ups. Look at the APPS ETSY FVRR charts from two days ago, that’s all you can do the next time is try to spot that recovery after a dip and manage around it. Having said that, I messed up not taking those (APPS was off limits because of earnings) for swings because I looked at them strictly as day trades or investments instead of cash flow trades to park my money w good r/r. We’re all gonna make mistakes regardless of experience, all you can do is reflect, learn, realize what’s happening the next time.

Very true about price anchoring. I find myself doing it and it's so stupid because I too often find myself doing it on positions that I plan to hold long term.

Makes no sense

- 36,272

- 11,072

- Joined

- Aug 2, 2008

GameStop just doing what GameStop does. You buy something for retail. Try to return it in two days to realize it’s now worth $1.50, $3.00 in store credit.

- 74,437

- 23,917

- Joined

- Apr 4, 2008

idc if I ever help you make money, but I Damn sure do care I help you not lose money unnecessarily. Idk what SAVA even does, but you can’t chase a stock that goes 20-90 in a day or two on no fundamental reason. Unless it’s a situation like TWLO in its spring earnings report last year where it was a killer quarter with monster volume after hours, that’s when it’s ok to chase big moves.johnnyredstorm thanks for saving me from chasing sava just like i did with amc

it’s human nature. This game is all about psychology. I passed on adding to SQ again at 222 because well idk why but I wanted to own more so I bot more today at 234 at the open because I knew PayPal’s quarter would be a good tailwind. If I price anchored, I would’ve missed all of my adds that helped build this position.Very true about price anchoring. I find myself doing it and it's so stupid because I too often find myself doing it on positions that I plan to hold long term.

Makes no sense

- 4,166

- 3,912

- Joined

- Jul 20, 2012

GameStop just doing what GameStop does. You buy something for retail. Try to return it in two days to realize it’s now worth $1.50, $3.00 in store credit.

it’s cringy seeing people say diamond hands after watching it for from $400 to damn near under $50

That’s why older people think we shouldn’t have access to these apps

- 6,776

- 13,698

- Joined

- Feb 3, 2012

My ZOM had a nice day.

- 29,556

- 20,798

- Joined

- Dec 23, 2009

PELOTON GOING ON SALE YALL. GET IN ASAP.

- 23,342

- 5,982

- Joined

- Jan 30, 2007

Not a bad day, only red I had is TSLA and SNDL.

- 3,301

- 558

- Joined

- Sep 3, 2009

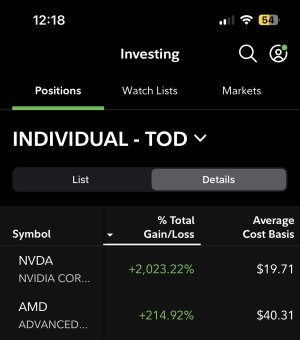

Same, did this with AVGO and NVDAVery true about price anchoring. I find myself doing it and it's so stupid because I too often find myself doing it on positions that I plan to hold long term.

Makes no sense

u gud fam?Most anticipated earnings report ever for me with Pinterest rn

- 74,437

- 23,917

- Joined

- Apr 4, 2008

PINS just entered the FB stage. This could be a $200 stock by 2022. You’re welcome

Similar threads

- Replies

- 20

- Views

- 758