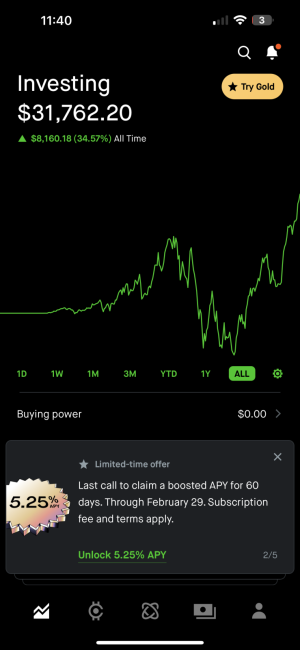

- 5,504

- 13,457

- Joined

- Aug 1, 2017

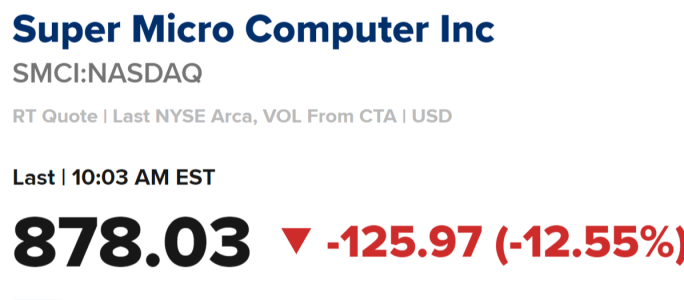

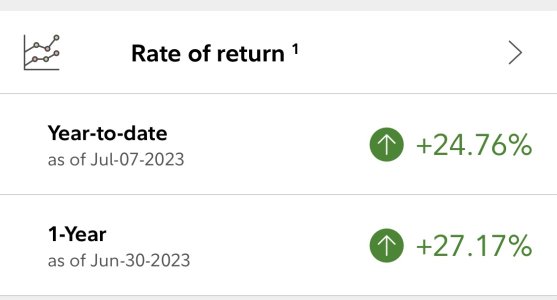

Not letting myself get too excited until market closes, but obviously today looks super promising. And still not going to get TOO excited unless we put together a few green days in a row. But it sure was nice to wake up and see the market looking promising instead of dreadful.

I don’t own TSLA but about a third of my portfolio is FBGRX and their biggest holding by far (last time info was public) was TSLA, so hoping for a nice bump today.

I don’t own TSLA but about a third of my portfolio is FBGRX and their biggest holding by far (last time info was public) was TSLA, so hoping for a nice bump today.

I hate this game.

I hate this game.

But its decent, green candles on the 4hr getting more volume than the red this week, which is nice to see.

But its decent, green candles on the 4hr getting more volume than the red this week, which is nice to see.