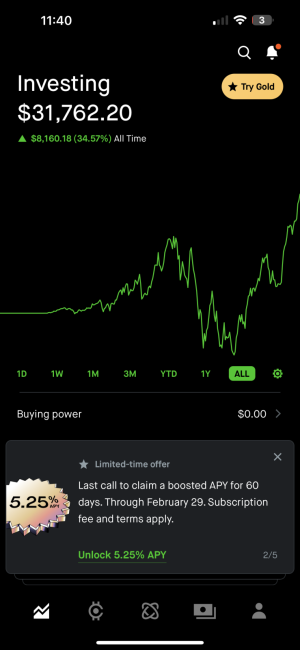

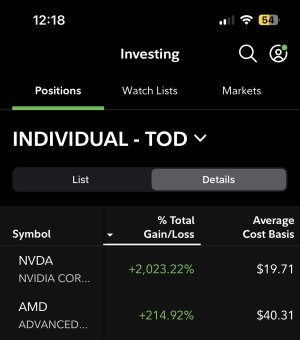

- 8,142

- 5,318

- Joined

- Dec 3, 2007

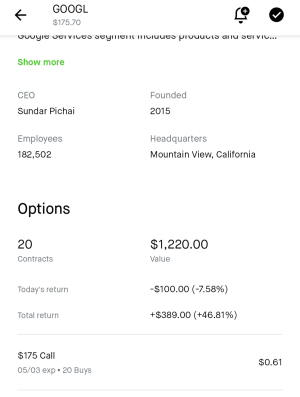

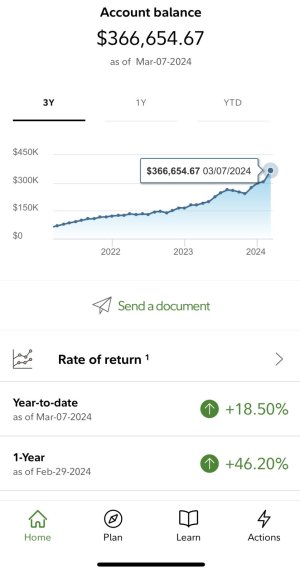

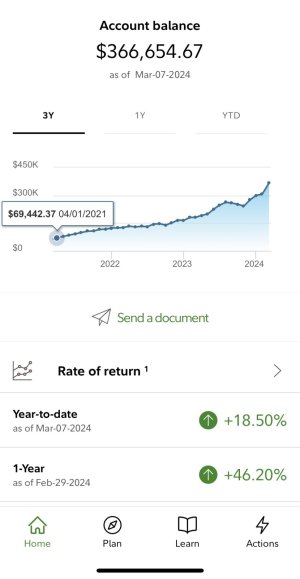

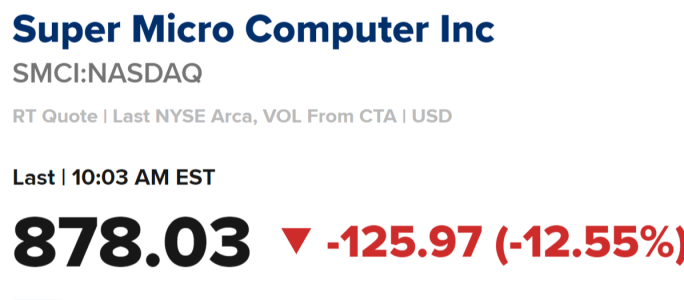

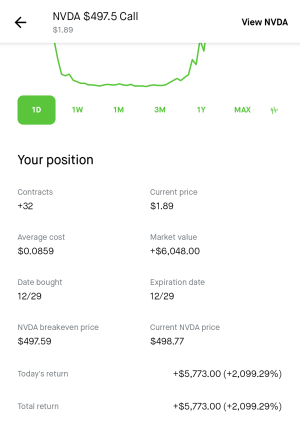

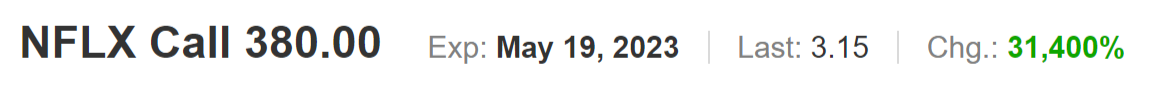

^^bruh...this ishh is slightly scary. There's certainly gonna be a sell-off soon. I just don't know if I should be humble and take my profit with one more week to expiry or if I should risk it and diamond hand this *****.

...

...

. I'm a high school teacher, this is more than a months salary. Going right to the savings account.

. I'm a high school teacher, this is more than a months salary. Going right to the savings account.