- 5,822

- 6,768

- Joined

- Jul 3, 2015

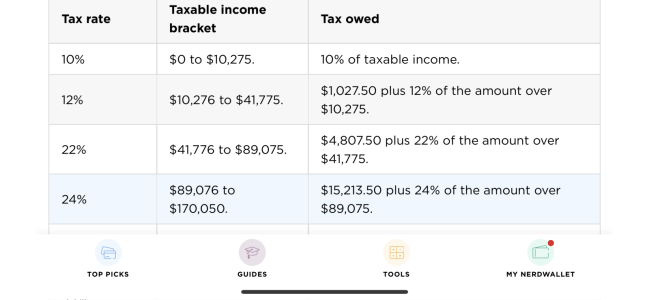

Yeah I got one too because a friend was using my old PayPal for a while, shut it down after I got that 1099 from PayPal,Got a 1099 from Paypal because I'm in MA. $6000+ sales apparently. Do I have to include it even if I'm maintaining that none of it was profit? Essentially selling off old sh*t.

Had to pay back to the irs because of it, lost mad money