- 11,832

- 24,698

- Joined

- Oct 10, 2018

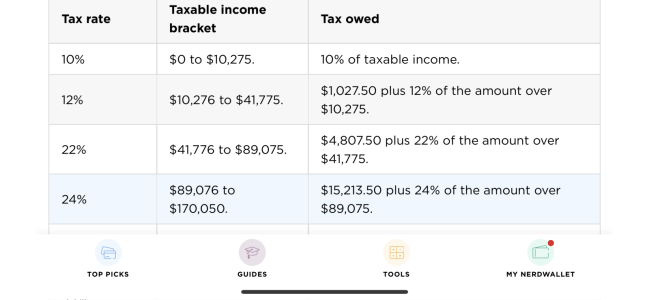

Why do i get less and less on my tax return every year when i havent changed my w-4?

im assuming its just tax laws thats causing this?

im assuming its just tax laws thats causing this?