- 74,532

- 23,967

- Joined

- Apr 4, 2008

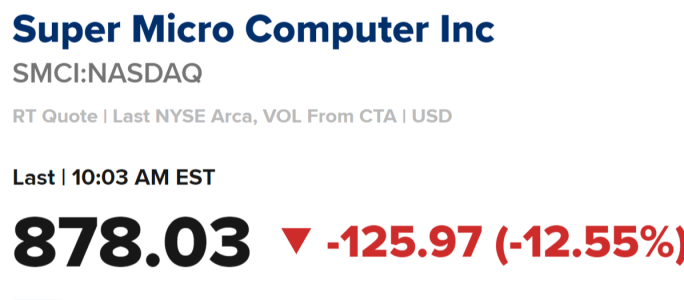

eh at this point im running with a limited amount of cash free that I want to hold in case of a new cml pick or add to what I own.Never too late, though theres definitely diminishing returns at this point. Still pissed I sold out at 330 a share last year.

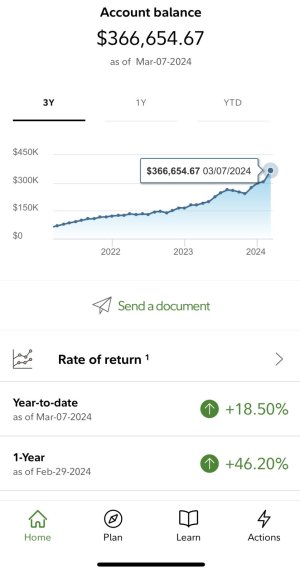

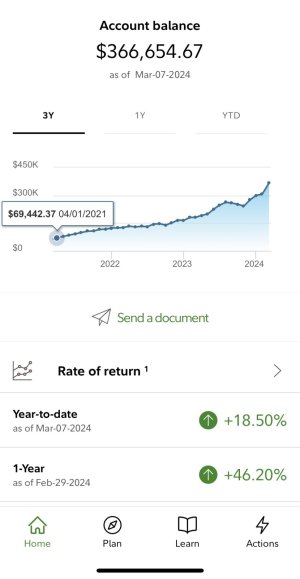

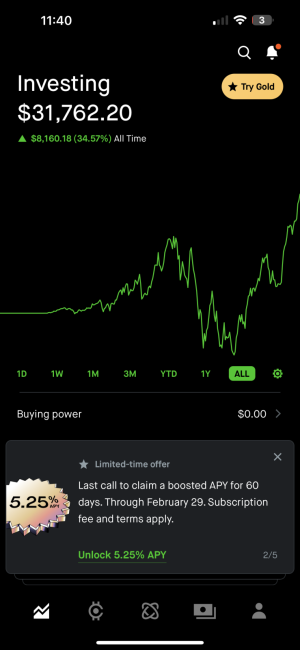

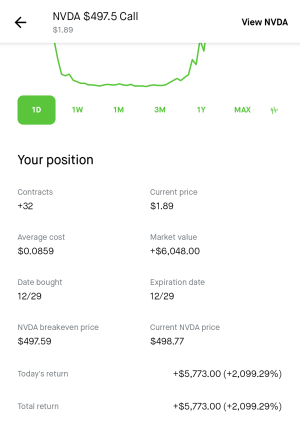

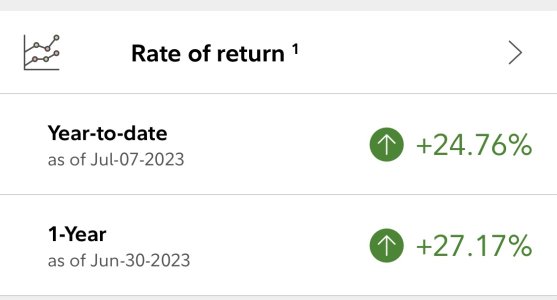

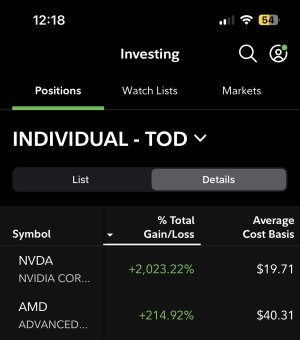

, nvda (541). No complaints here. Stock side of my portfolio in my Schwab account is back to being up 8.49% and tos with my pins put spreads is up to 40% after being rekt from October and the pfe vaccine.

, nvda (541). No complaints here. Stock side of my portfolio in my Schwab account is back to being up 8.49% and tos with my pins put spreads is up to 40% after being rekt from October and the pfe vaccine.