- 29,683

- 20,949

- Joined

- Dec 23, 2009

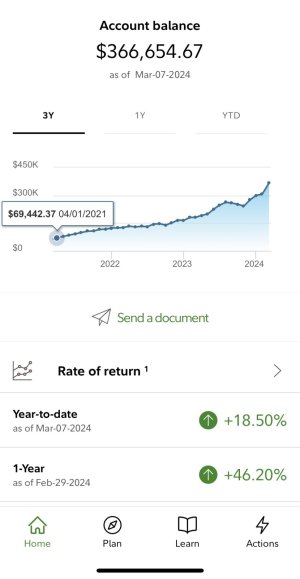

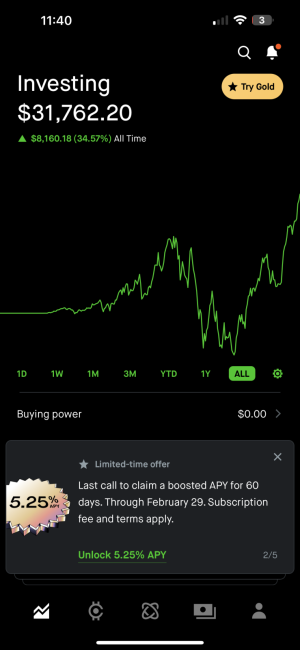

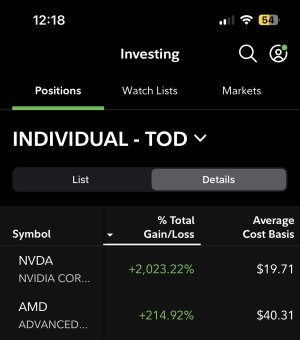

Bruh I'd take whatever tax hit the govt wants if I made TWELVE MILLION on Tesla from an 18 thousand dollar investmentI gotta assume he has other stuff, but there's no way in hell that it isn't 90%+ of his portfolio. He is a wild boy.

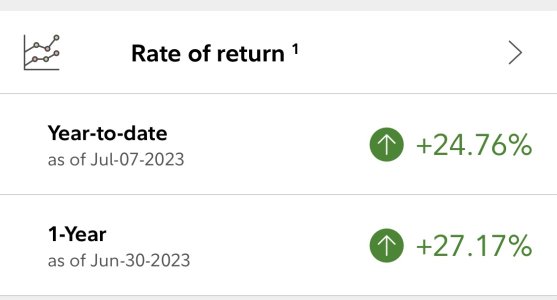

I would be taking the tax hit on like a third of this and hope that the Long Term Cap Gain tax rate doesn't move with a blue wave in place. Open up a tax-loss harvesting account with Wealthfront or something in case he needs to sell down more.

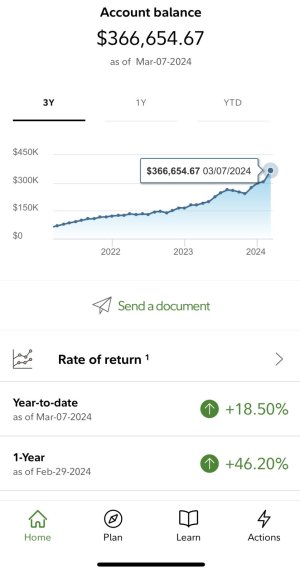

Sucks but it's not like hes hurting with 7Ms in this one account (5 others? Definitely diversified like you said).

Sucks but it's not like hes hurting with 7Ms in this one account (5 others? Definitely diversified like you said).