antidope

Supporter

- 62,402

- 65,257

- Joined

- Jan 2, 2012

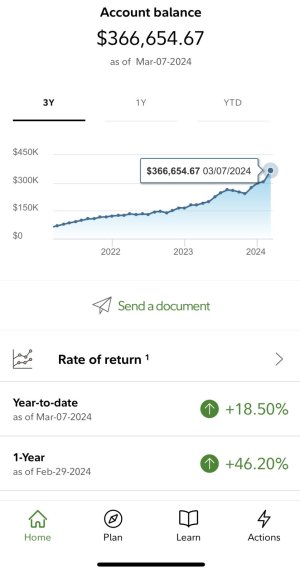

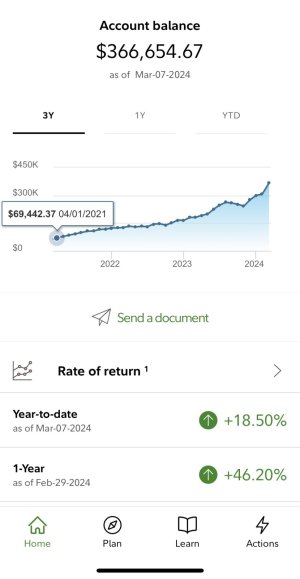

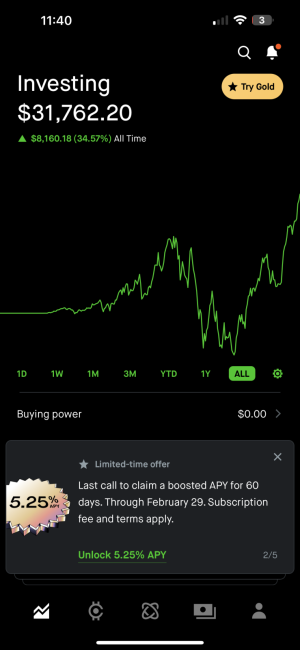

Mine is ALL passive just like you. Fee compression is not a joke, its the biggest detractor from returns. My 401k costs me a whopping 0.01% in fees.I don't do much either. but ive been throwing chump change at my works 401k for 5-6 years now . It's not losing money. But it's not gaining too crazy either. 2019 was a bad market year. I think I was up 10% for all of 2020.

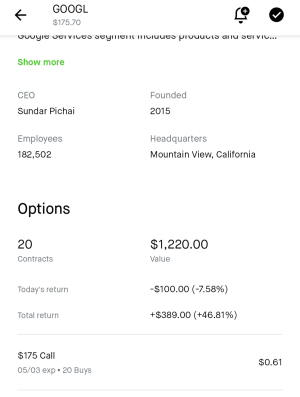

I may have my hands into too many indexes. Thoughts?

Sp500 / sp400/ Russell index/ us reit. Percentages have shifted every 2-3 months. Sp500 is doing well. Us reint was doing great precovid. But I'm hopeful the vaccine pushes these places into reopening. Sometimes I'll do 30/20/25/25. Or push it to 40/20/20/20. Or any sort of combo.

Is this chump change better invested in a long term stock that has decent dividends?

Strategy Selection is where we differ. 60% Large Cap Growth/40% S&P 500.

The S&P 500 is about 3% REITs, that's a big bet to be taking on REITs, not saying you're wrong I really don't like giving allocation advice cause it's such a personal thing.

Even if I could access single stock in my 401k I wouldn't this is my "sleep well" money, I don't really tweak it much and its not really a place I would go active. If you have an IRA alongside that then that's a different story.

Which Russell Index? Based on the rest of the sub-asset classes you own, I'm assuming its the Russell 2000 for Small Cap?