- 12,344

- 4,712

- Joined

- Mar 30, 2004

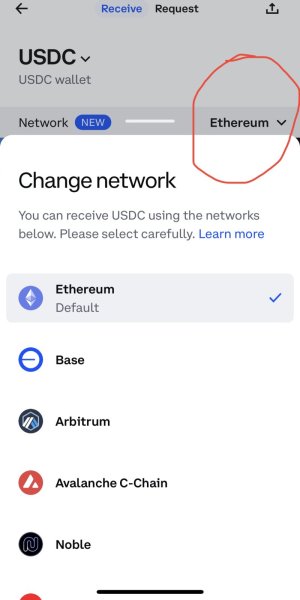

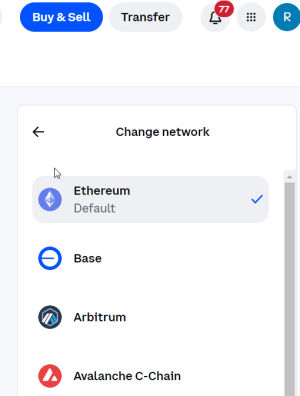

Instead of sending ETH or BTC from Coinbase to KuCoin (FEES), use XLM or LTC. That $20 in gas it cost you to transfer your ETH could've gotten you 500 more TEL.I just messed around until I figured it out.

well I had to convert some eth which pissed me off because I'm trying to hoard it.

anyways, I made my kucoin account, then went to my Coinbase account and sent some eth to my kucoin.

so hit deposit on kucoin, then select eth or btc. copy that wallet address, then go to your exchange with your eth or btc and hit withdraw to another wallet and paste that copied ku coin wallet address.

it will take a few minutes for it to hit your account.

THEN hit assets, click your main account, transfer you coins to your trading account

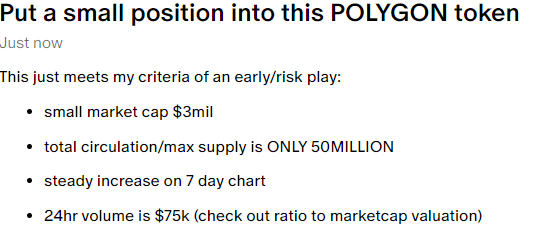

then hit markets on the left, look up the TEL that coordinates with what you deposited either eth or btc

then you can buy it, just do a market order so hit "market" then buy your TEL.

No need to verify your identity on KuCoin unless you're gonna be withdrawing more than 2 BTC worth of funds. You should be able to deposit/trade/withdrawal right now (unless they pause that when you begin the verification process).Still getting my identity verified by KuCoin.

been about 5 days now