- 4,248

- 4,243

- Joined

- Jul 20, 2012

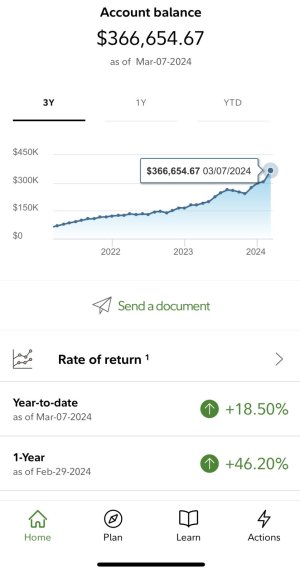

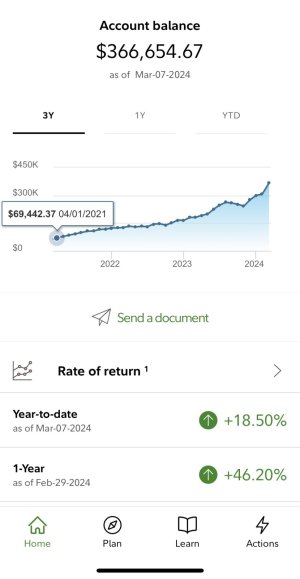

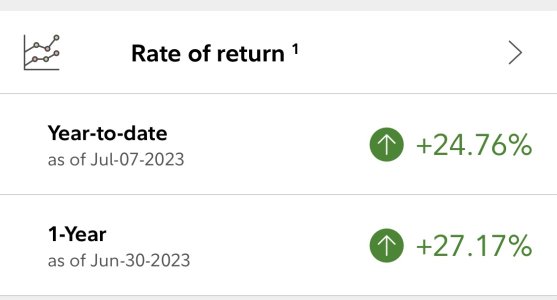

I likeFidelity is the definition of legit. In business over 70 years. They are their own clearinghouse. They handle over a TRILLION dollars. And it is rare, RARE, to hear any controversies from them. They also offer the most research for users.

Some people don’t like the UI, especially compared to RH. That’s the one complaint I hear about them. I don’t have a problem with it.

Fidelity

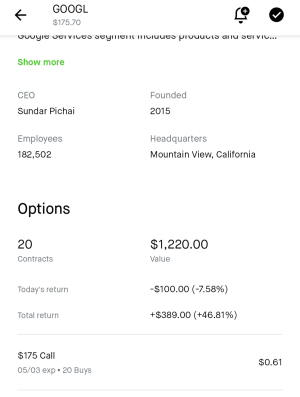

But their platform is not fast enough for option traders

will up the ante.

will up the ante.