- 4,590

- 6,874

- Joined

- Jan 14, 2014

Anyone in or heard of Paysafe? Ran across them and saw that they were teaming up with Coinbase, which caught my attention.

Looked at their ratings and numbers, and since their price was so low I took the jump. If anyone else has any other insight on how they look please share.

Paysafe’s Skrill Expands Crypto Offering to US With Coinbase

Paysafe, a leading specialized payments platform, today announced that its Skrill digital wallet has expanded its cryptocurrency offering to the U.S.

www.businesswire.com

Looked at their ratings and numbers, and since their price was so low I took the jump. If anyone else has any other insight on how they look please share.

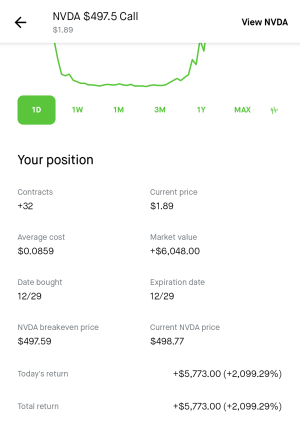

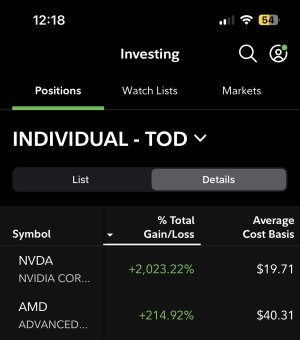

AI Progress Depends on Semiconductors

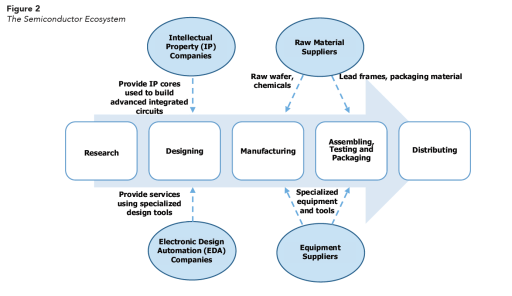

AI Progress Depends on Semiconductors Semiconductor Supply Chain (Source: TSMC)

Semiconductor Supply Chain (Source: TSMC) Supply Chain Overview – SIA

Supply Chain Overview – SIA

NVDA Data Center Business – Source: NVDA Investor Presentation

NVDA Data Center Business – Source: NVDA Investor Presentation AI TAM – Source: NVDA Investor Presentation

AI TAM – Source: NVDA Investor Presentation

Widespread Usage of TensorFlow

Widespread Usage of TensorFlow TPU v3 Pod with Better Performance

TPU v3 Pod with Better Performance Why Protein Folding is So Complex

Why Protein Folding is So Complex

The Cerebras WSE is Massive

The Cerebras WSE is Massive Cerebras WSE Comparison

Cerebras WSE Comparison