- 1,870

- 1,641

- Joined

- May 30, 2015

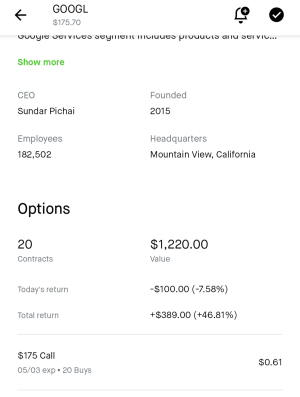

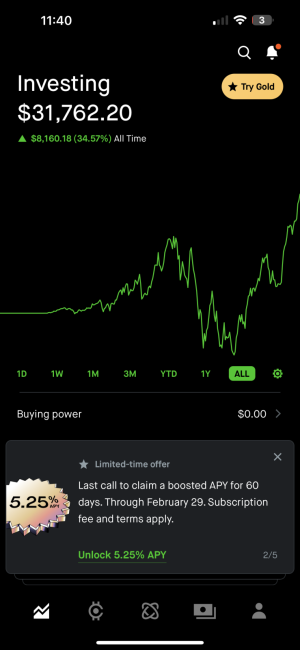

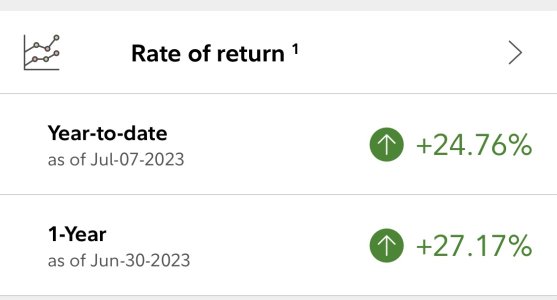

Eyeg went up 35% too

I bought a bit of cei today

I stopped by lottery scratchers and use that money just to buy stocks even if it’s a dub a week or a lil more from time to time.

also bought about 400 shares of CEI at ~.30. will sell 200 shares at ~.60-.75 if/when it gets to that and hold the rest