- 18,115

- 11,769

- Joined

- Jan 11, 2013

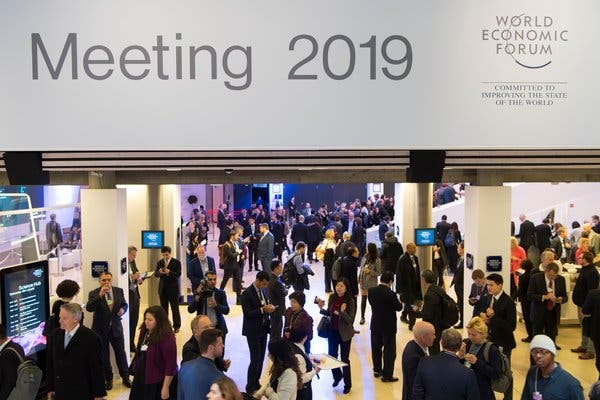

"The Hidden Automation Agenda of the Davos Elite"

This year’s World Economic Forum in Davos, Switzerland, where business leaders’ public positions on automation’s impact on workers did not match the views they shared privately.

http://www.unz.com/isteve/the-hidden-automation-agenda-of-the-davos-elite/

This year’s World Economic Forum in Davos, Switzerland, where business leaders’ public positions on automation’s impact on workers did not match the views they shared privately.

http://www.unz.com/isteve/the-hidden-automation-agenda-of-the-davos-elite/

From the New York Times:

DAVOS, Switzerland — They’ll never admit it in public, but many of your bosses want machines to replace you as soon as possible.

I know this because, for the past week, I’ve been mingling with corporate executives at the World Economic Forum’s annual meeting in Davos. And I’ve noticed that their answers to questions about automation depend very much on who is listening.

In public, many executives wring their hands over the negative consequences that artificial intelligence and automation could have for workers. …

But in private settings, including meetings with the leaders of the many consulting and technology firms whose pop-up storefronts line the Davos Promenade, these executives tell a different story: They are racing to automate their own work forces to stay ahead of the competition, with little regard for the impact on workers.

… They crave the fat profit margins automation can deliver, and they see A.I. as a golden ticket to savings, perhaps by letting them whittle departments with thousands of workers down to just a few dozen.

… Now they’re saying, ‘Why can’t we do it with 1 percent of the people we have?’”

… Kai-Fu Lee, the author of “AI Superpowers” and a longtime technology executive, predicts that artificial intelligence will eliminate 40 percent of the world’s jobs within 15 years. …

But at a time of political unrest and anti-elite movements on the progressive left and the nationalist right, it’s probably not surprising that all of this automation is happening quietly, out of public view….

One common argument made by executives is that workers whose jobs are eliminated by automation can be “reskilled” to perform other jobs in an organization.